SETL Launches Blockchain-Powered OpenCSD Platform

PRESS RELEASE: SETL OpenCSD enables market participants to run permissioned registry service for payments, settlement and clearing of cash and other financial instruments.

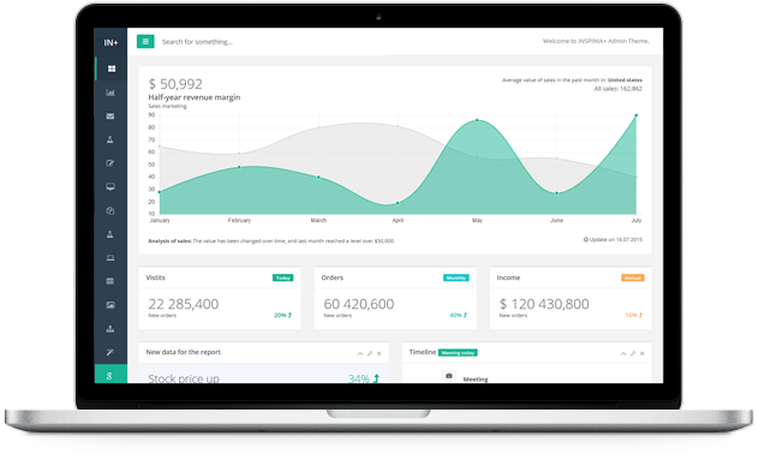

London, 1 June 2016: SETL, the institutional payment and settlement infrastructure based on blockchain technology, has today announced the launch of its blockchain-powered OpenCSD platform. The OpenCSD platform, SETL’s first commercial offering, enables any market participant to commission and run a permissioned registry service for payments, settlement and clearing of cash and other financial instruments. The platform is available today and powered by the SETL blockchain technology, which has been benchmarked to settle billions of transactions a day in real-time.

Peter Randall, CEO of SETL, said: “The time has come to stop talking about the characteristics of blockchain and to start realising its promise. Our OpenCSD platform will revolutionise the way securities depositories and payments systems are organised. A group of participants can now permission a working blockchain platform in a matter of minutes and jointly record and settle changes in ownership. This will help bring competition into a segment of financial markets which has thus far been dominated by quasi-monopolistic incumbents.”

SETL’s OpenCSD platform has been designed to be compatible with existing and forthcoming regulations such as the European CSDR, but is not specific to any particular regulatory model and, as such, is jurisdictionally agnostic. The OpenCSD platform builds an organisational functionality on top of the SETL blockchain engine.

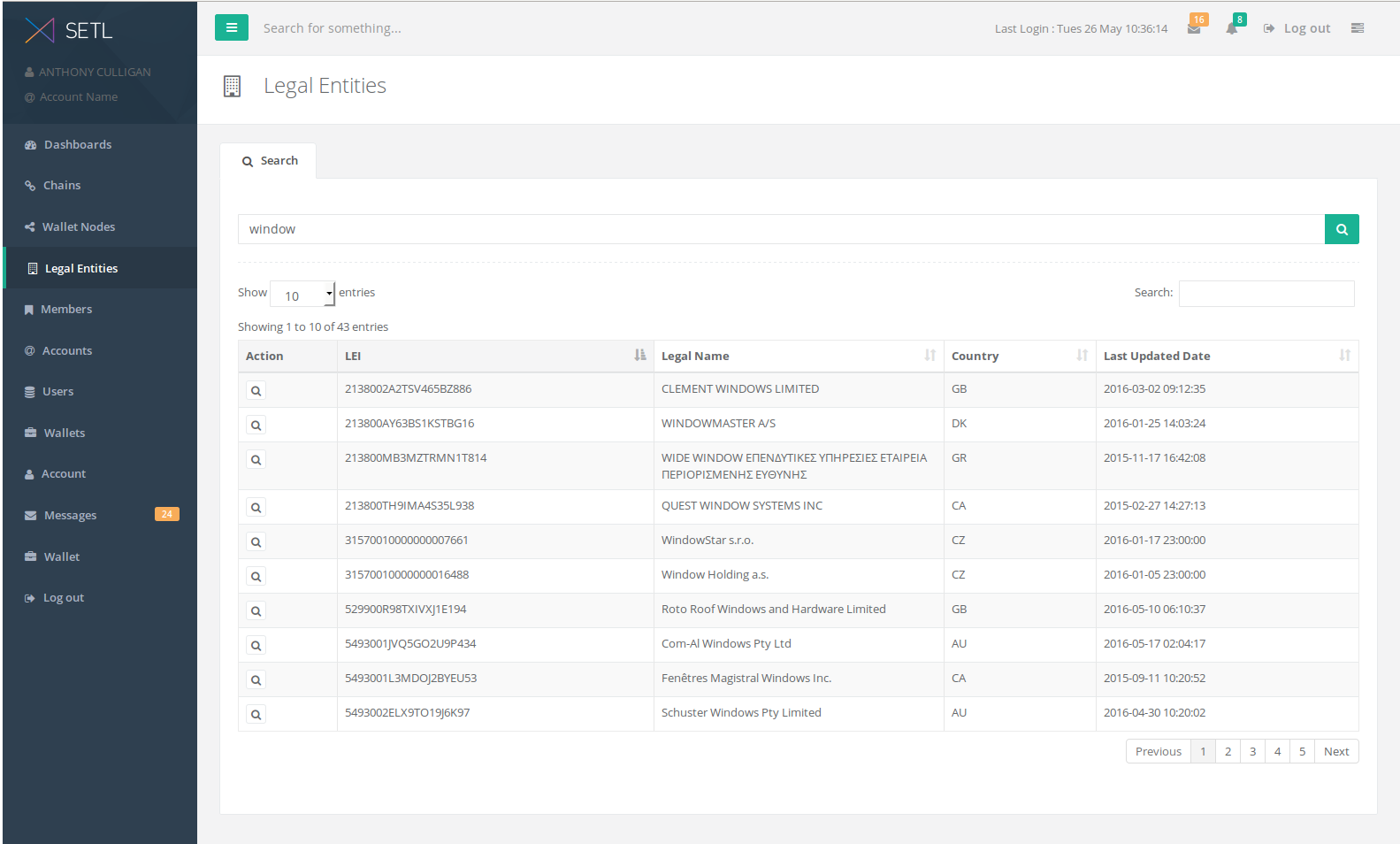

The OpenCSD functionality comprises four main components: 1) a permissioned membership structure; 2) a range of control functions including clearing, settlement and corporate actions; 3) liquidity functionality including collateral and repo facilities; and 4) a secure messaging system which can be used to transmit ISO messages as well as enable bespoke communications between participants in a highly secure environment. Furthermore, the OpenCSD functionality will provide granular identity services by enabling participants to use industry initiatives, such as the Legal Entity Identifier (LEI) system, to allow authority and transaction management. Use of the OpenCSD platform in some applications in some jurisdictions will require prior regulatory approval.

The OpenCSD platform will enable the interaction of different participants, including custodians, registrars and payment institutions. It can be used co-operatively or deployed by a single institution to maintain registers for their own customers. It is asset neutral and works across securities, private equity or as a platform for FX or e-money. Assets held on one instance of the platform can be transferred to other instances subject to the agreement of both parties.

Peter Randall, CEO of SETL, continued, “The OpenCSD platform heralds a new era of interoperability, efficiency and flexibility for issuers and asset owners alike, to collaborate and establish their own settlement destinations. It is a means for market participants to empower themselves and to design services around their own needs and cost expectations. We envisage service providers plugging into these projects to provide facilities such as issuer support, payments and valuation. We expect to work with a number of companies in these areas to support these initiatives.”

The SETL OpenCSD platform is available on a subscription basis and is accessible through a secure user interface and via a functionally-rich API. SETL expects to take on a limited number of subscribers for the first phase of the roll-out. In addition, SETL will establish a development partner programme, which will engage with financial technology companies who wish to design and build functionality around the OpenCSD platform.