A Few Words: The Case For Disruption In The Post Trade World And SETL’s Blockchain.

By Peter Randall, SETL President

7/16/2019

Moore’s Law works both ways, on the one hand the power of technology on the chip doubles in a 24-36-month period and for many the price of such a doubling sees a net fall in the price of processing power. On the other hand, computer hardware that costs ten-million USD, say, eight years ago can now be replaced with much faster and effectively cheaper machines today. This is the incumbent’s dilemma. Not only are the new machines cheaper in terms of processing power, they are often cheaper in price as well. So, a big financial market incumbent that has spent many tens of millions of dollars on its full stack of technology can effectively be disintermediated by more modern technology at a fraction of the price.

We have seen this behaviour in many areas of the financial markets landscape. Certainly, front office applications, market data feeds, trading engines and the like have been steadily and inexorably getting faster, more powerful and cheaper over the last two decades. To date the biggest stand-out against such a trend has been the cosy world of post trade. In most financial market infrastructures that cater for the post trade end of the market there has been very little technological change over the past twenty years. In part, this state of affairs has been possible as such services are seen by many market participants as effectively ‘shared services’ and thus there is little competitive advantage in differentiating a specific service. However, as revenues become increasingly hard to find and the drive for growth at the bottom line continues unabated, focus is starting to move towards reviewing, reducing, and reforming the assumptions and foundations of the post trade landscape.

To be sure there are many different flavours of post trade infrastructure and they are often specifically focused on a part of the settlement work-flow. Some deal with risk, some deal with messaging, some deal with reporting, some deal with delivery versus payment, some deal with final money settlement. They are mostly well adapted services in their specific area and deal with their allocated place on the post trade journey. However, this is to miss the point. The existing system is well adapted to the technological capabilities of the various institutions and work-flows that existed about 20 years ago. Risk reducing systems like central counterparties were necessary then because it would take two or three days for the ‘system’ to align assets and cash in place for final settlement. Reporting systems were often batch run and final money settlement used a set of messaging protocols that even then were ill-suited to being used for anything other than instructing RTGS systems. And all this to transfer the record of ownership of an asset between two parties on the ledger of a registrar. In addition to all this complexity there is the relentless ka-ching, ka-ching of the cash registers of all the parties to this fandango.

Complexity, high cost, ill-suited protocols and slow, these are all very attractive ideas to those that wish to innovate, disrupt and replace. From the point of view of a simple investor how can it take 2- 3 minutes to order, pay for and take delivery of a cup of coffee at a coffee shop but 2-3 days to order, pay for and take delivery of a share in the coffee shop’s equity? This is perverse given that one of these assets is a physical thing, the cup of coffee, and the other is an entry on an electronic ledger, the equity.

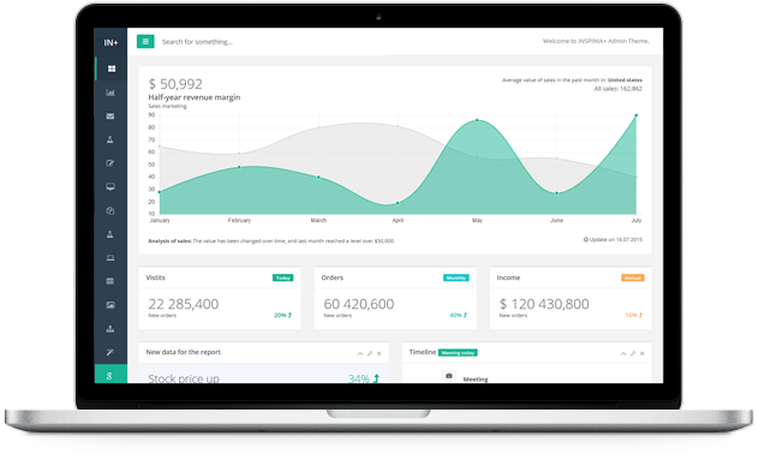

In seeking to simplify, reduce cost, standardise protocols and speed things up, SETL uses its permissioned and proprietary blockchain to offer disruption in this space. Let’s examine a few selected topics and see how a distributed ledger can deliver sustainable innovation and disruption.

- Risk, in essence this is a function of time and the nature of the counterparties, clearly reducing the time that it takes for counterparties to achieve final settlement reduces risk. Using SETL’s blockchain time ‘on risk’ can be reduced from 2-3 days to as little as 5 seconds. Counterparty identities are managed in a much more effective fashion.

- Notwithstanding the reduction in risk and thus the reduction in the ‘price’ paid to manage that risk, the SETL blockchain allows all the parties that need to be advised of a trade and receive the various transaction reports to receive an identical message, all at the same time.

- The inputs and outputs of the SETL blockchain are also standard and are managed by our industry leading product called SETL Connect that converts all legacy messaging standards and manages all the interactions between the counterparties to the trade and the SETL blockchain where the records of the individual trade are stored.

- Because the SETL blockchain can comfortably perform at speeds of 30k transactions per second, it has more than enough raw processing power to speed up the work-flows and offers a very close to real time experience for post trade infrastructure participants.

Disruption to existing processes is often a function of a better service delivered at a lower price using more flexible technology.